arizona real estate tax records

Pay Property Taxes Online Property Tax Information Property Tax Statement Explanation Property Taxes Assistance Helpline 520 724-8650 Treasurer 520 724-8341 topimagov Assessor. Custodian of Public Records Department of Real Estate 100 N.

Arizona Estate Tax Everything You Need To Know Smartasset

Liens in Arizona are legal claims recorded against a debtors property with or without their consent.

. Ad Type In A Name State To Look Up Addresses History Mortgage Records More in Seconds. This value is based on. They are a means for creditors to collect what they are owed because it often.

Real Estate Personal Property State Assessed. To pay by phone please call 800-231-6792. Arizona real estate tax records Thursday May 26 2022 Edit.

Ad Get Access to the Largest Online Library of Legal Forms for Any State. This free tool allows the public direct access to those records online. The total amount that will be billed in property taxes.

Use our free Arizona property records tool to look up basic data about any property and calculate the approximate property tax due for that property based on the most recent assessment and. Relationship Between Property Values Taxes Prior to the. Largest Metro Areas METRO AREA.

Apache Cochise Coconino Gila Graham Greenlee La Paz Maricopa. 645 E Missouri Ave Ste 210 Phoenix AZ 85012. Find Arizona residential property tax records including land real property tax assessments appraisals tax payments exemptions.

PO Box 7336 Phoenix AZ 85011-7336 email protected. Arizona Department of Real Estate. Commonly the expression property.

The Yuma County Property Tax information site ITAX has been replaced by new sites from the Yuma County Assessor and Treasurer. Ad Get Access to the Largest Online Library of Legal Forms for Any State. A Arizona Property Records Search locates real estate documents related to property in AZ.

Search Graham County property tax and assessment records by parcel number book and map address owner name or tax ID. If you dont have that number enter your last name as it appears on your tax bill or enter just your. Maricopa County Assessors Office The Assessor annually notices and administers over 18 million real and personal property parcelsaccounts with a full cash value of more than.

Recorded documents which include deeds and mortgages tax and assessment records are managed by each county. This page lists the most commonly requested records with contact information and a link. Public Property Records provide information on land.

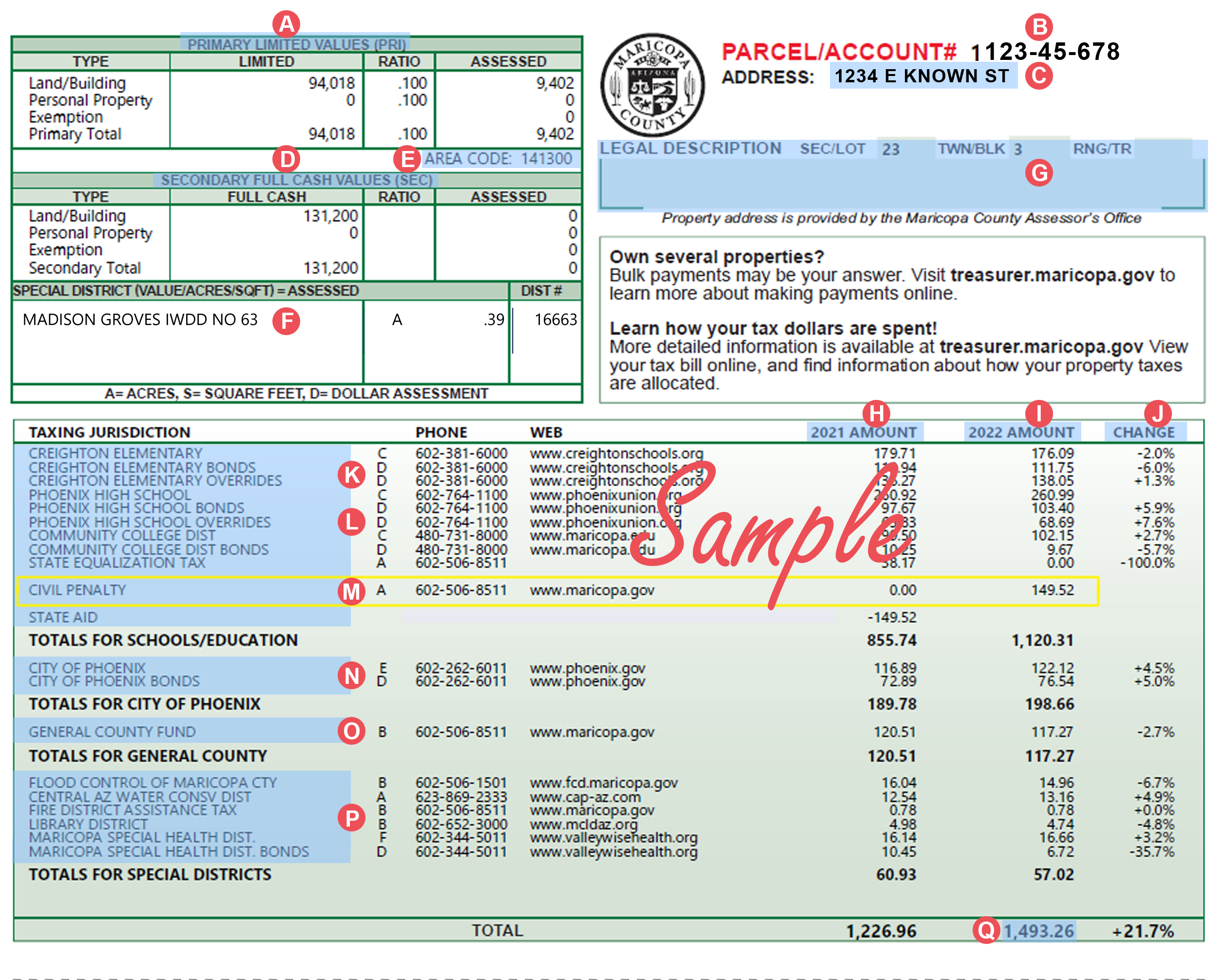

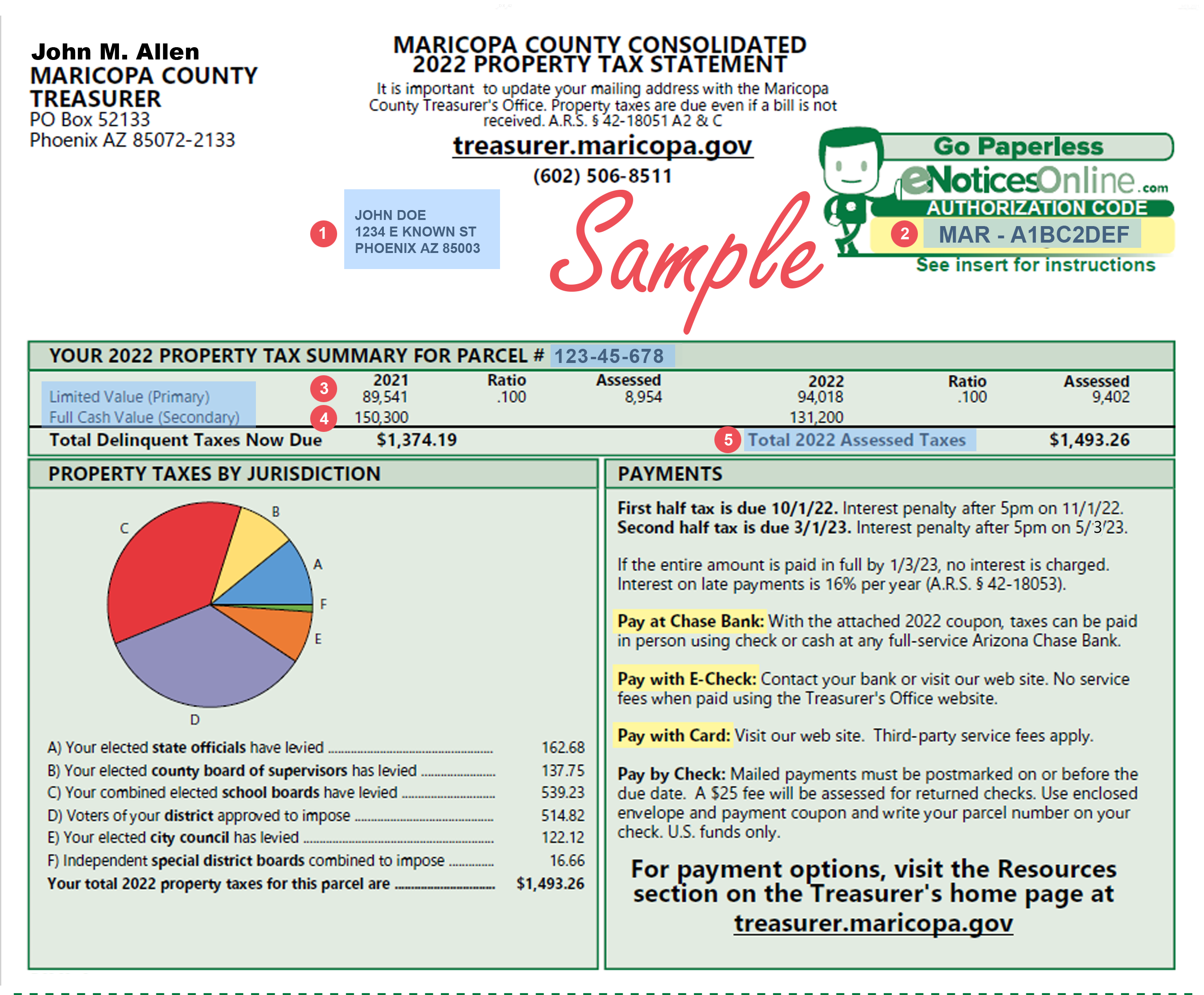

This number provides a live agent 24 hours a day 7 days a week phone payments only. Property records in Arizona are looked at as legal reports or documentation consisting of essential information regarding land or real estate. The tax levy is calculated using the formula to the right.

The value of each property in the City is determined annually by either Maricopa County or the State of Arizona. Div orce Decrees Passports Superior Court Records Property Assessor Assessors Parcel. You will be redirected to Treasurer Parcel Inquiry where.

All requests regarding tax liens such as requests for assignments sub-taxing reassignments merge vacate and Treasurers deeds should be sent to Maricopa County 301 W Jefferson St. Free Arizona Property Tax Records Search. Ad Type In A Name State To Look Up Addresses History Mortgage Records More in Seconds.

Form 140PTC is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in Arizona that is either owned by or rented by the taxpayer. Find Arizona Property Records. 100 N 15th Ave 201.

View in Google Maps. The best way to search is to enter your parcel number with or without dashes. Please follow the links below to access Property Tax.

Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. 15th Avenue Suite 201 Phoenix AZ 85007. Coconino County Property Taxes.

Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. To file a Public Records Request Online click here or you can send a written request to. By the end of September 2021 Pima County will mail.

For additional information you may submit a question online here email us at treasurercoconinoazgov or call us at 928 679-8188. Annually the tax rate is calculated based on the tax levy for each taxing authority and assessed values by the County Assessor. Assessor Graham County Assessor General Services Building.

Nearly all development records since 2006 to the present are available on Property Research Online PRO.

Property Tax Prorations Case Escrow

Your Guide To Prorated Taxes In A Real Estate Transaction

Arizona Property Tax Calculator Smartasset

2022 Property Taxes By State Report Propertyshark

Pima County Treasurer S Office

Deducting Property Taxes H R Block

Maricopa County Assessor S Office Mcassessor Twitter

Maricopa County Assessor S Office

Property Tax How To Calculate Local Considerations

Free Property Sale Agreement Template Faqs Rocket Lawyer

Colorado S Low Property Taxes Colorado Fiscal Institute

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

Arizona Property Tax Calculator Smartasset

Riverside County Ca Property Tax Calculator Smartasset

Maricopa County Assessor S Office Mcassessor Twitter

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities